Jeremy Grantham, the perennial bear has turned...bullish? Grantham believes that the Presidential cycle is powerful and the short term effects of the stimulus (as well as moral hazard). However he doesn't see this new Bull Market lasting for two long. In fact he is quite bearish long term and suggests an 85% probability that "we face a long, drawn-out period to reach a new (inflation-adjusted) high (up to 20 years)".

So is Grantham right? Another twenty years to hit inflation-adjusted 14,000 on the Dow? Only time will tell.

Ironically, for those 50 and under this is not bad news as it gives you a great chance to dedicate a portion of your monthly income to stocks at reasonable prices and if markets go lower, really good prices. For those in retirement, this doesn't mean the end has come, stocks also pay dividends (though not as much now) and this makes up part of your return - the key is not to have too much allocated to stocks in retirement.

Grantham's First Quarter letter is linked above and is actually quite entertaining, in fact I've been wondering if he had a few too many sips of his favorite scotch before writing it! He obviously had fun reveling in the market crash, I guess I'm glad someone did.

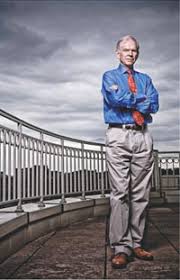

Scott Dauenhauer CFP, MSFP, AIF